- This event has passed.

Don’t Leave Dollars on the Table: Valuable 2022 Tax Incentives for Restaurants

September 22, 2022 @ 11:00 AM - 12:00 PM

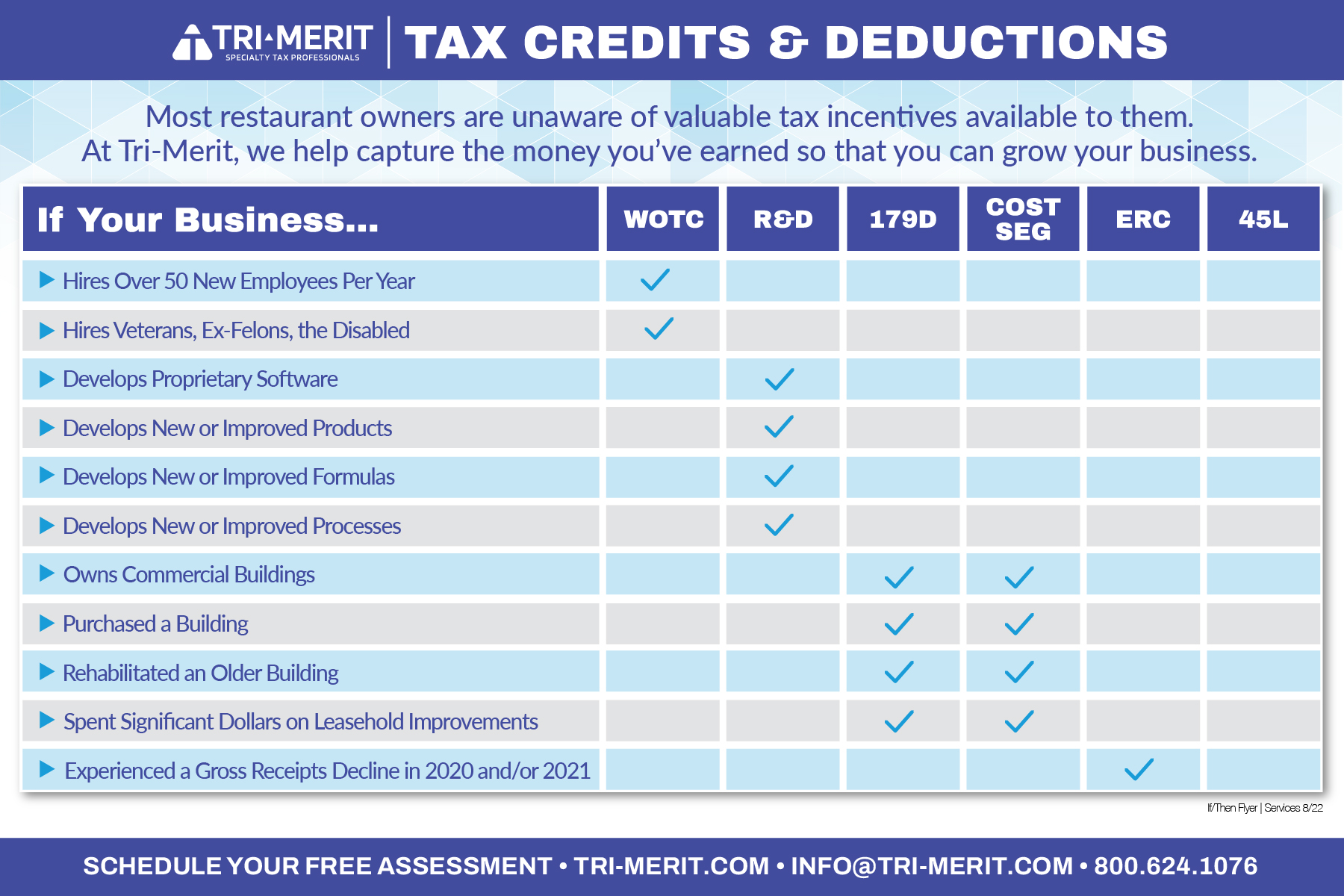

Lucrative tax incentives are available to many Colorado restaurant owners — so don’t leave those dollars on the table!

Please join the CRA during this free webinar to learn how you can qualify for powerful tax credits and deductions to increase cash flow and grow your business.

Randy Crabtree, CPA and co-founder of Tri-Merit Specialty Tax Professionals, will share the latest updates on the Work Opportunity Tax Credit, Cost Segregation, 179D Commercial Building Energy-Efficiency Tax Deduction, and the R&D Tax Credit.

Randy, who also hosts “The Unique CPA” podcast, is a widely followed author and speaker in the accounting industry. Randy was listed in the “Ones to Watch” section of Accounting Today’s 2021 “Top 100 Most Influential people in Accounting.” He was recently appointed to the Intuit Tax Council. Prior to starting Tri-Merit, Crabtree was managing partner of a CPA firm in the greater Chicago area. Randy has more than 30 years of public accounting and tax consulting experience in a wide variety of industries and has worked closely with top executives to help them optimize their tax planning strategies.